McCulloch v. Maryland Decision

3/6/1819

Add to Favorites:

Add all page(s) of this document to activity:

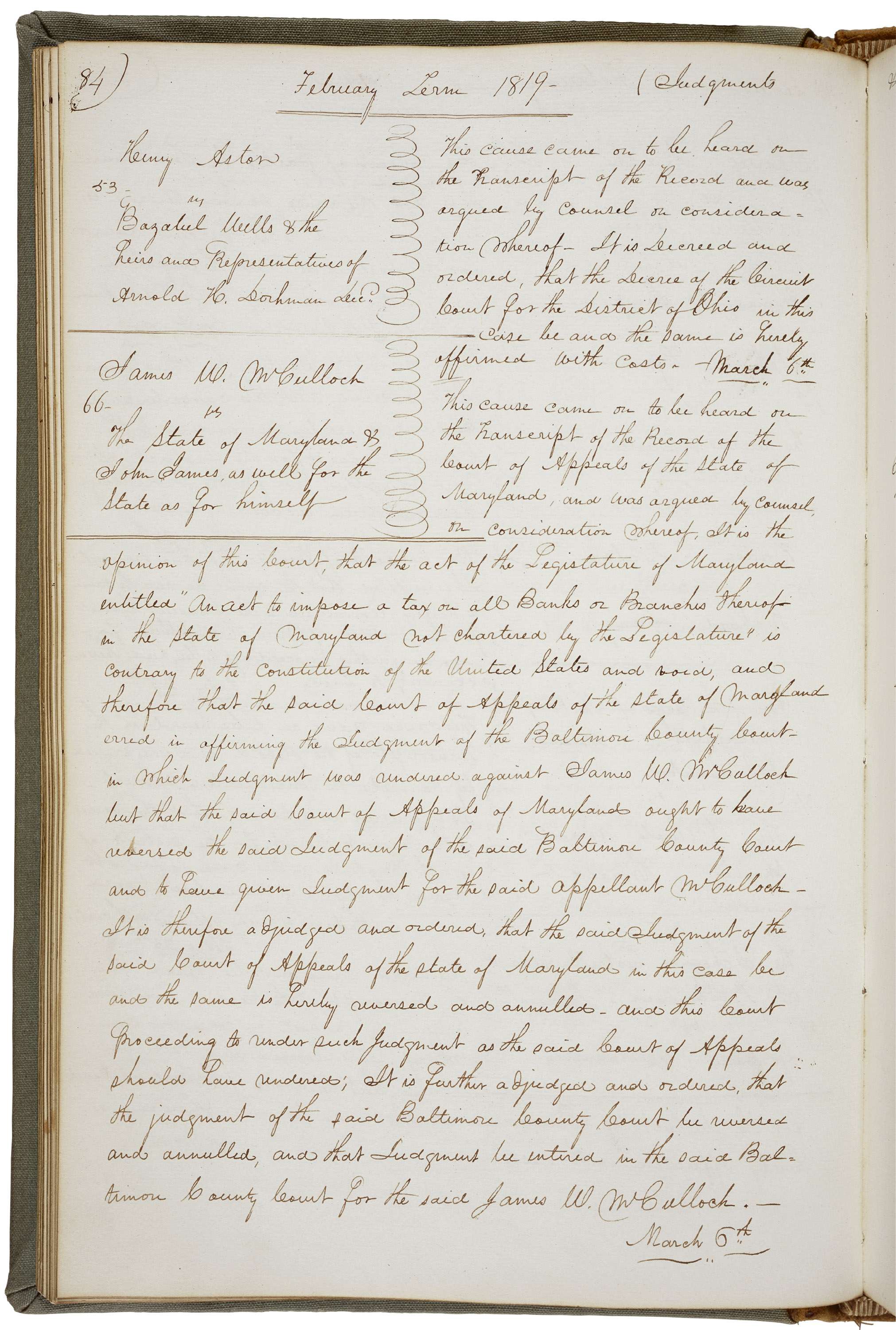

This document shows the Supreme Court's decree in McCulloch v. Maryland. It comes from a volume of Supreme Court minutes describing the proceedings of the Court.

In this landmark Supreme Court case, Chief Justice John Marshall handed down one of his most important decisions regarding the expansion of Federal power. This case involved the power of Congress to charter a bank, which sparked the even broader issue of the division of powers between state and the Federal Government.

In 1816, Congress established the Second National Bank to help control the amount of unregulated currency issued by state banks. Many states questioned the constitutionality of the national bank, and Maryland set a precedent by requiring taxes on all banks not chartered by the state — in 1818, the State of Maryland approved legislation to impose taxes on the Second National Bank chartered by Congress.

James W. McCulloch, a Federal cashier at the Baltimore branch of the U.S. bank, refused to pay the taxes imposed by the state. Maryland filed suit against McCulloch in an effort to collect the taxes. The Supreme Court, however, decided that the chartering of a bank was an implied power of the Constitution, under the "elastic clause," which granted Congress the authority to "make all laws which shall be necessary and proper for carrying into execution" the work of the Federal Government.

This case presented a major issue that challenged the Constitution: Does the Federal Government hold sovereign power over states? The proceedings posed two questions: Does the Constitution give Congress power to create a bank? And could individual states ban or tax the bank?

The court decided that the Federal Government had the right and power to set up a Federal bank and that states did not have the power to tax the Federal Government. Marshall ruled in favor of the Federal Government and concluded, "the power to tax involves the power to destroy."

In this landmark Supreme Court case, Chief Justice John Marshall handed down one of his most important decisions regarding the expansion of Federal power. This case involved the power of Congress to charter a bank, which sparked the even broader issue of the division of powers between state and the Federal Government.

In 1816, Congress established the Second National Bank to help control the amount of unregulated currency issued by state banks. Many states questioned the constitutionality of the national bank, and Maryland set a precedent by requiring taxes on all banks not chartered by the state — in 1818, the State of Maryland approved legislation to impose taxes on the Second National Bank chartered by Congress.

James W. McCulloch, a Federal cashier at the Baltimore branch of the U.S. bank, refused to pay the taxes imposed by the state. Maryland filed suit against McCulloch in an effort to collect the taxes. The Supreme Court, however, decided that the chartering of a bank was an implied power of the Constitution, under the "elastic clause," which granted Congress the authority to "make all laws which shall be necessary and proper for carrying into execution" the work of the Federal Government.

This case presented a major issue that challenged the Constitution: Does the Federal Government hold sovereign power over states? The proceedings posed two questions: Does the Constitution give Congress power to create a bank? And could individual states ban or tax the bank?

The court decided that the Federal Government had the right and power to set up a Federal bank and that states did not have the power to tax the Federal Government. Marshall ruled in favor of the Federal Government and concluded, "the power to tax involves the power to destroy."

Transcript

84 [top left]Februrary Term 1819 [underlined]

(Judgments [not shown on facing page: & Decrees)]

53

Henry Aston

vs

Bazalul Wells & the heirs and Representatives of Arnold H. Dorhman Dec.

[to right of divide]

This cause came on to be heard on the Transcript of the Record and was argued by Counsel on consideration whereof - it is Decreed and ordered, that the Decree of the Circuit Court for the District of Ohio in this case be and the same is hereby affirmed with costs. -March 6th

66

James W. McCulloch

vs

The State of Maryland & John James, as well for the State as for himself

[to right of divide and below]

This cause came on to be heard on the Transcript of the Record of the Court of Appeals of the State of Maryland, and was argued by Counsel, on consideration whereof. It is the opinion of this Court, that the act of the Legislature of Maryland entitled "And Act to impose a tax on all Banks or Branches thereof in the state of Maryland not chartered by the Legislature" is contrary to the Constitution of the United States and void, and therefore that the said Court of Appeals of the Sate of Maryland erred in affirming the Judgment of the Baltimore County Court - in which Judgement was rendered against James W. McCulloch but that the said Court of Appeals of Maryland ought to have reversed the said Judgment of the said Baltimore County Court and to have given Judgment for the said appellant McCulloch - It is therefore adjudged and ordered that the said Judgement of the said Court of Appeals of the state of Maryland in this case be and the same is hereby reversed and annulled - and this Court proceeding to render such Judgment as the said Court of Appeals should have rendered; It is further adjudged and ordered that the judgment of the said Baltimore County Court be reversed and annulled, and that Judgment be entered in the said Baltimore County Court for the said James W. McCulloch. —

March 6th

This primary source comes from the Records of the Supreme Court of the United States.

Full Citation: Decree in McCulloch v. Maryland; 3/6/1819; Engrossed Minutes, 2/1790 - 6/7/1954; Records of the Supreme Court of the United States, Record Group 267; National Archives Building, Washington, DC. [Online Version, https://docsteach.org/documents/document/mcculloch-v-maryland, April 19, 2024]Rights: Public Domain, Free of Known Copyright Restrictions. Learn more on our privacy and legal page.