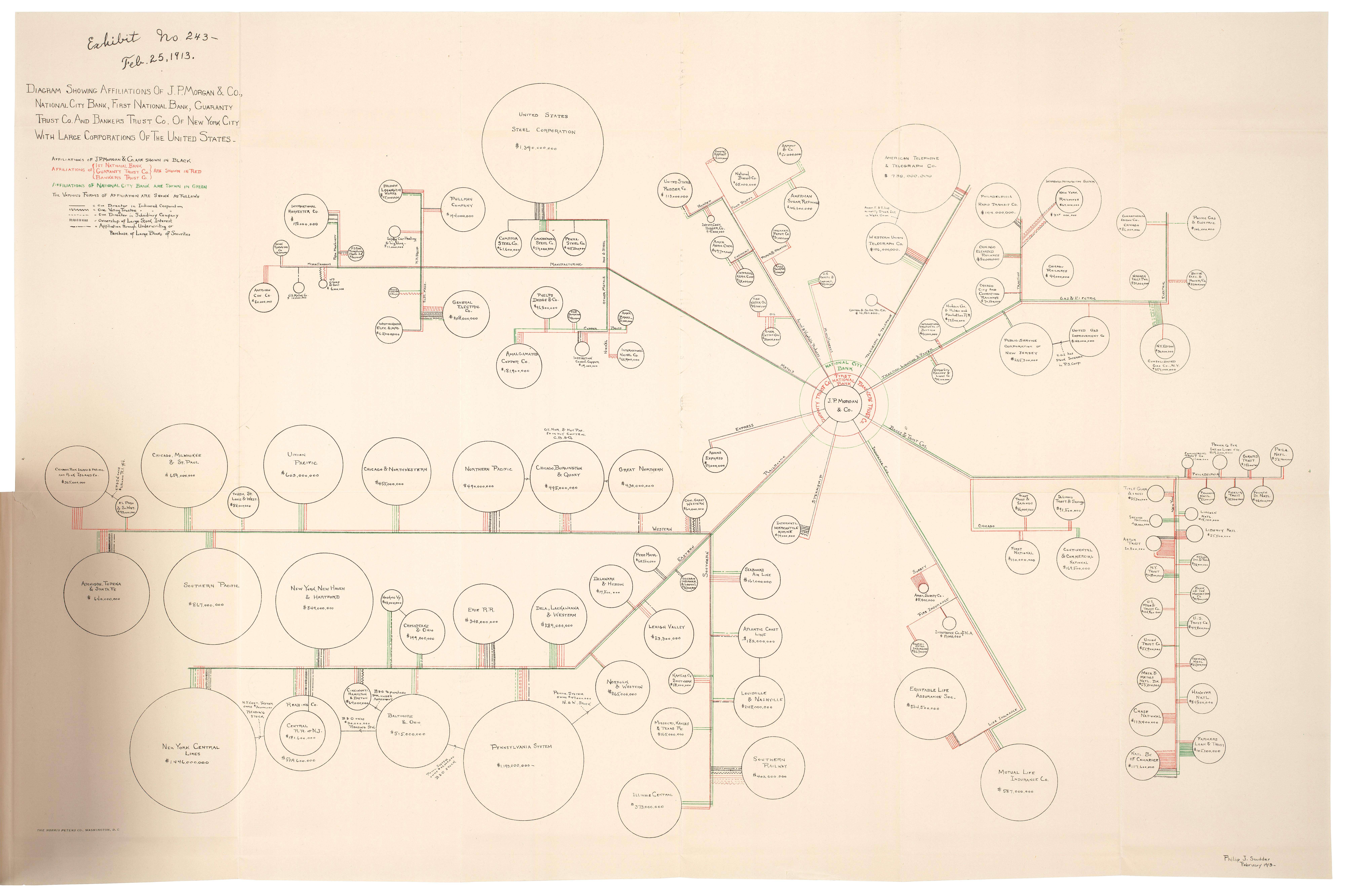

Diagram Showing Affiliations of Banks with Large Corporations

1913

Add to Favorites:

Add all page(s) of this document to activity:

From 1890-1910, investment banks, such as J.P. Morgan and Co., gained a controlling interest in many major corporations. The banks influenced corporate decisions by exercising the authority to appoint members of the corporations’ boards of directors. By creating interlocking directorships and trusts (a trust is a group of separate companies brought under the control of a single managing board to reduce or eliminate competition and maximize profits), banks coordinated the activities of many companies to act in concert with the goals of the bank. This network was referred to as the “money trust,” and the public demanded that Congress get to the bottom of it.

The House Banking Committee, led by Chairman Arsene Pujo and investigator Samuel Untermyer, investigated the Money Trust of investment bankers and exposed their network of economic influence. This diagram shows connections between J. P. Morgan & Co., National City Bank, First National Bank, Guaranty Trust Co., and Bankers Trust Co. of New York City with large corporations in the United States. It was presented as exhibit 243 in House Report 1593, the Report of the Money Trust Investigation of the Committee on Banking and Currency.

As a result of the Pujo Committee investigation, Congress passed the Clayton Anti-trust Act to ban interlocking directorships, created the Federal Trade Commission to oversee economic competition, and created the Federal Reserve to lessen the control of the Money Trust over the nation's money supply.

The House Banking Committee, led by Chairman Arsene Pujo and investigator Samuel Untermyer, investigated the Money Trust of investment bankers and exposed their network of economic influence. This diagram shows connections between J. P. Morgan & Co., National City Bank, First National Bank, Guaranty Trust Co., and Bankers Trust Co. of New York City with large corporations in the United States. It was presented as exhibit 243 in House Report 1593, the Report of the Money Trust Investigation of the Committee on Banking and Currency.

As a result of the Pujo Committee investigation, Congress passed the Clayton Anti-trust Act to ban interlocking directorships, created the Federal Trade Commission to oversee economic competition, and created the Federal Reserve to lessen the control of the Money Trust over the nation's money supply.

This primary source comes from the Records of the U.S. House of Representatives.

National Archives Identifier: 138930942

Full Citation: Exhibit 243 of House Report 1593, the Report of the Money Trust Investigation of the Committee on Banking and Currency; 1913; Committee Reports from the 62nd Congress; (HR62A-E3); Original Committee Reports, 1861 - 1972; Records of the U.S. House of Representatives, Record Group 233; National Archives Building, Washington, DC. [Online Version, https://docsteach.org/documents/document/affiliations-banks-corporations, April 18, 2024]Rights: Public Domain, Free of Known Copyright Restrictions. Learn more on our privacy and legal page.